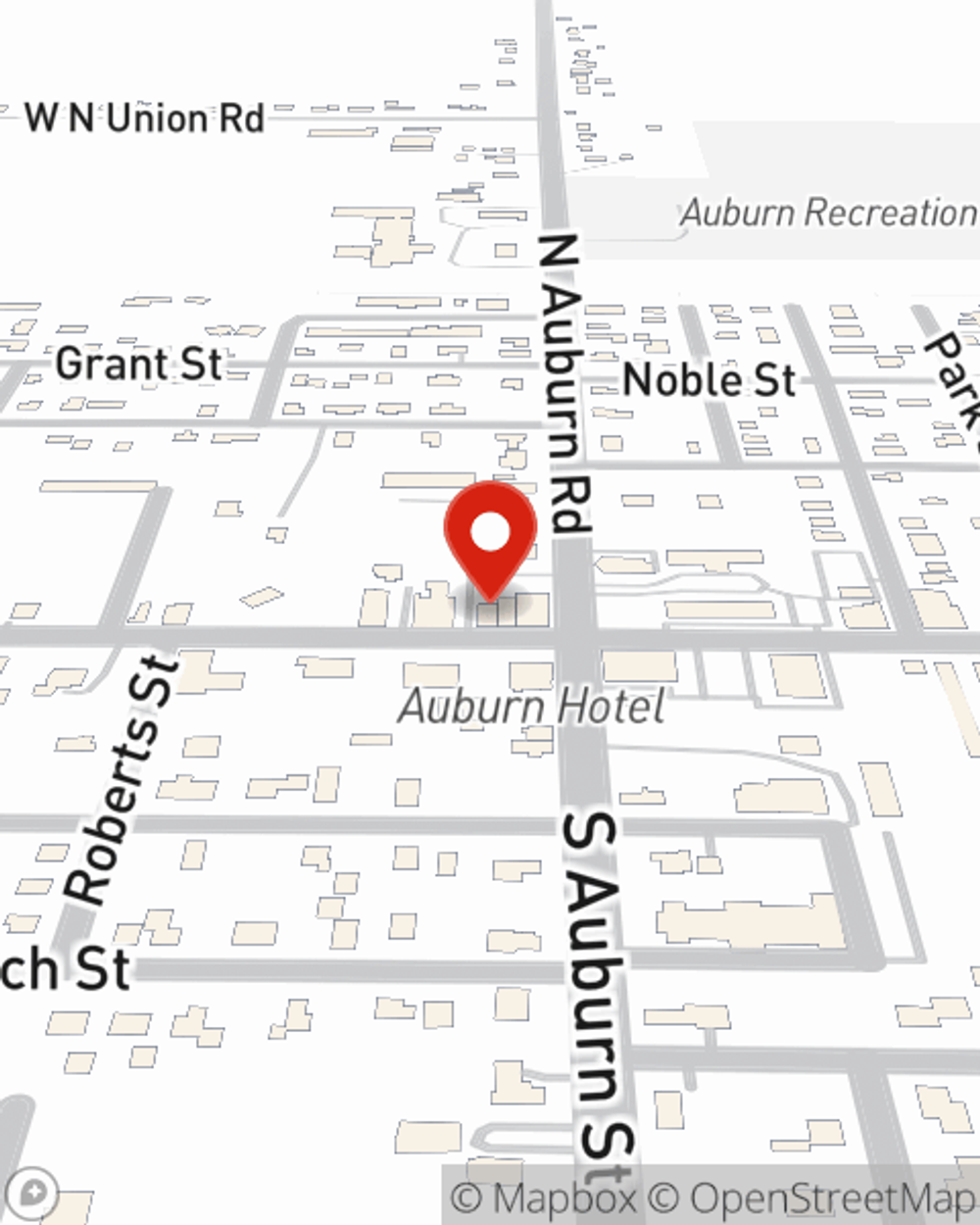

Business Insurance in and around Auburn

Looking for protection for your business? Look no further than State Farm agent Brad Martin!

Helping insure small businesses since 1935

- Auburn

- Bay City

- Midland

- Saginaw

- Essexville

- Freeland

- Clare

- Coleman

- Sanford

- Linwood

- Pinconning

- Farwell

- Caro

- Bridgeport

- Birch Run

- Standish

- Frankenmuth

- Chesaning

- Great Lakes Bay

- Michigan

- Central Michigan

- TriCities

Help Prepare Your Business For The Unexpected.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a staff member gets hurt on your property.

Looking for protection for your business? Look no further than State Farm agent Brad Martin!

Helping insure small businesses since 1935

Cover Your Business Assets

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like extra liability or errors and omissions liability, that can be molded to develop a personalized policy to fit your small business's needs. And when the unexpected does happen, agent Brad Martin can also help you file your claim.

Take the next step of preparation and reach out to State Farm agent Brad Martin's team. They're happy to help you learn more about the options that may be right for you and your small business!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Brad Martin

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.